“It is useless to tell a river to stop running; the best thing is to learn how to swim in the direction it is flowing.”

According to the Deloitte[1]’s reports “Leadership for Growth” and “Marketing in 3D”, one third of chief financial officers do not believe that marketing is crucial to devising strategy. (Economic Times, 2008)

The Market

According to the “Pizza & Pasta Restaurant” Report (Mintel, 2008), an increasing affluence (UK GDP in the 2003-07 period + 6.%; Keynote, 2008), has been the main factor behind the growth, so that “eating out” is regarded as an “affordable part of today’s lifestyle instead of an occasional treat”.

Fig.2

According to the “Pizza & Pasta Restaurant” Report (Mintel, 2008), an increasing affluence (UK GDP in the 2003-07 period + 6.%; Keynote, 2008), has been the main factor behind the growth, so that “eating out” is regarded as an “affordable part of today’s lifestyle instead of an occasional treat”.

Yum! Brands Inc., the world's largest restaurant company, is an American-based company with more than 35,000 restaurants in more than 110 countries and territories (Yum website, 2008) and in UK operates with Yum! Restaurants Europe Ltd.

“Survival and fit depend upon the adaptability of the organisation and management’s ability to match strategy to this changing world” (Doyle, 2006 p.22)

Currently, two major macro-environmental changes are re-defining the Restaurant Industry: an environmental shock characterised by financial events (the “credit crunch”) and the creation of new market segments driven by a general healthier lifestyle.

However, in the long term the challenge is to win back disaffected customers, therefore the Pasta Hut test represents the biggest and toughest challenge for the group in UK to overcome its association with junk food.

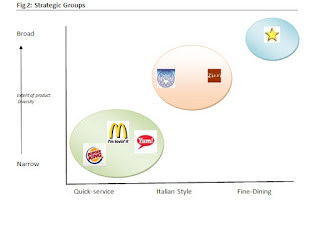

The Competitive Environment: Strategic Group Analysis

“Strategy is an essential part of any effective business plan. By using an effective competitive strategy, a company finds its industry niche and learns about its customers” (Porter M. cited in Emerald, 2006)

Indeed, Yum Brand Inc. as member of this group enjoys a position hardly attainable by members of others strategic groups, due to ““mobility barriers” (see Figure 3) that often involves a cost of entry that effectively gives a cost advantage over potential entrants.

Hence, this membership has allowed the firm to concentrate on a successful expansion strategy, to develop new markets (e.g. China), finance massive marketing campaigns[25]and to take part in aggressive price-wars with its group rivals.

On the other hand, the pitfall is a reduction of the profit margins (due to price-wars) being compounded by a recent rise food prices.

The “Facebook” application (see Appendix III) goes in this direction but the “Pizza Hut” menus is limited only to Pizza[26], reflecting therefore a short term objective to gain a larger market share in the younger segment of the market.

[1] Deloitte Touche Tohmatsu (also branded as Deloitte) is one of the largest professional services firms in the world and one of the Big Four auditors, along with PricewaterhouseCoopers, Ernst & Young, and KPMG. (www.deloitte.com)

[2] “The business enterprise has two--and only two--basic functions: marketing and innovation. Marketing and innovation produce results; all the rest are costs.(Drucker cited in Forbes, 2006)

[3] The report defines restaurants as eating places that supply meals or food for consumption on the premises by UK consumers, except roadside catering and contract catering.

[4] At the end of 2006 financial year

[5] The same report forecasts a growth of 22.5% between 2009 and 2013; however with the UK economy heading towards a Recession this projection is likely to be revised downward.

[6] “The result is that there will be several high-profile casualties as the growth that was servicing debts evaporates and companies are unable to meet their obligations”. (Mintel: Restaurant, 2008)

[7] Necessities (time-poor workers), willingness to try new food and an higher sophistication of the consumer’s taste are mentioned by all three report consulted: Restaurant 2008 (Keynote) Pizza &Pasta Restaurant 2008 and Restaurant 2008 (Mintel) as the factors supporting future demand

[8] Key Drivers for changes are environmental factors that are likely to have an high impact on the success or failure of strategy. (Johnson et al, 2006 p.56)

[9] The report defines restaurants as eating places that supply meals or food for consumption on the premises by UK consumers, except roadside catering and contract catering.

[10] At the end of 2006 financial year

[11] The same report forecasts a growth of 22.5% between 2009 and 2013; however with the UK economy heading towards a Recession this projection is likely to be revised downward.

[12] “The result is that there will be several high-profile casualties as the growth that was servicing debts evaporates and companies are unable to meet their obligations”. (Mintel: Restaurant, 2008)

[13] Necessities (time-poor workers), willingness to try new food and an higher sophistication of the consumer’s taste are mentioned by all three report consulted: Restaurant 2008 (Keynote) Pizza &Pasta Restaurant 2008 and Restaurant 2008 (Mintel) as the factors supporting future demand

[14] Key Drivers for changes are environmental factors that are likely to have an high impact on the success or failure of strategy. (Johnson et al, 2006 p.56)

[15] The Yum! China Division (includes mainland China, Thailand and KFC Taiwan).

[17] Managing director of the China Market Research Group

[18]Burger King joins McDonald’s and Yum! In China announcing plans to open between 250 and 300 outlets over the next five years ( The Economist, 2008)

[20] “An once-in-a-lifetime crisis, and possibly the largest financial crisis of its kind in human history”.( Charlie Bean, deputy governor of the Bank of England cited in The Times Online, 2008)

[21] In September 2008 the group reported a 39 per cent fall in first-half pre-tax profits, while Tragus, said like-for-like sales increased 3.4 per cent in the 12 months to May 25, compared with a 9.7 per cent increase seen the year before. (FT, 2008)

[22] "We are better suited than most to perform even in times of economic turmoil” (Novak D. cited in Forbes,2008)

[25] Yum Brand has spent in UK in 2008 a combined £35,626,000 with the Pizza Hut and KFC brands

[26] And KFC obviously only to chicken

Bibliography

Books

Doyle, P. & Stern, P. (2006). Marketing Management and Strategy (Fourth Ed.). London: Pearson Education Limited.

Johnson, G., Scholes, K. & Whittington, R. (2008). Exploring Corporate Strategy (Eight Ed.). London: Pearson Education Limited.

Kotler, P., Armstrong, G., Saunders, J., & Wong, V. (2005). Principles of Marketing (Fourth European ed.). London: Pearson Education Limited.

Online Articles

Yum! to you … David Novak on Yum! Brands 10 years of global growth.( 2007). Bnet [Internet], 15 October 2007. Available from: [Accessed November 10, 2008].

Yuk P.W. (2008) Tragus hurt as diners lose their appetite. Financial Times [Internet], 15 September 2008. Available from :< http://www.ft.com/cms/s/0/88e7f068-8356-11dd-907e-000077b07658.html?nclick_check=1> [Accessed November 11, 2008].

Trout, J.(2006). Peter Drucker on Marketing. Forbes [Internet],07 March 2006. Available from: [Accessed November 6, 2008].

Yum brands predicts profit growth for 2009. (2008). Forbes [Internet], 06 August 2008. Available from: [Accessed November 03, 2008].

O'Flaherty, K., (2008). Marketing Trends: In the name of progress - Marketing Week. [Internet], 16 October 2008. Available from: [Accessed November 13, 2008].

McDonald's profit up, but worries weigh.(2008). Reuters [Internet], 22 October 2008. Available from: [Accessed November 11, 2008].

Clark, N. (2008). Marketing can prove its worth in the boardroom. The Economic Times [Internet],15 October 2008. Available from: [Accessed 05 November 2007].

Guardian. [Internet], 21 October 2008. Available from:

Laurance, J., (2008). Diabetes may cause first fall in life expectancy for 200 years . The Independent. [Internet], 20 October 2008. Available from :< http://www.independent.co.uk/life-style/health-and-wellbeing/health-news/diabetes-may-cause-first-fall-in-life-expectancy-for-200-years-966914.html> [Accessed November 15, 2008].

Name change for Pizza Hut (2008) The Independent. [Internet], 06 October 2008. Available from: [Accessed November 15, 2008].

Websites

Deloitte Global Home Page - Deloitte Touche Tohmatsu [Internet]. Available from: [Accessed November 14, 2008].

Restaurant (2008) Keynote [Internet], October 2008. Available from: < http://0-www.keynote.co.uk.lispac.lsbu.ac.uk/kn2k1/CnIsapi.dll?nuni=34041&usr=11844srv=03&alias=kn2k1&uni=1226711466&fld=J&Jump=ViewPDF>[Accessed 05 November 2008].

Pizza and Pasta Restaurants - UK January 2008- Market Research Report (2008). Mintel [Internet], January 2008. Available from: [Accessed 06 November 2008].

Restaurants - UK - April 2008 - Market Research Report. (2008). Mintel [Internet], April 2008. Available from:

Yum! Brands, Inc. (2008).[Internet]. Available from: [Accessed November 10, 2008].

Online Journal Articles

Allen, R.S. & Helms, M.M. (2006). Linking strategic practices and organizational performance to Porter's generic strategies. Business Process Management Journal, 12(4), 433-454. Available from: [Accessed November 10, 2008].

[1] Deloitte Touche Tohmatsu (also branded as Deloitte) is one of the largest professional services firms in the world and one of the Big Four auditors, along with PricewaterhouseCoopers, Ernst & Young, and KPMG. (www.deloitte.com)

[2] “The business enterprise has two--and only two--basic functions: marketing and innovation. Marketing and innovation produce results; all the rest are costs.(Drucker cited in Forbes, 2006)

[3] The report defines restaurants as eating places that supply meals or food for consumption on the premises by UK consumers, except roadside catering and contract catering.

[4] At the end of 2006 financial year

[5] The same report forecasts a growth of 22.5% between 2009 and 2013; however with the UK economy heading towards a Recession this projection is likely to be revised downward.

[6] “The result is that there will be several high-profile casualties as the growth that was servicing debts evaporates and companies are unable to meet their obligations”. (Mintel: Restaurant, 2008)

[7] Necessities (time-poor workers), willingness to try new food and an higher sophistication of the consumer’s taste are mentioned by all three report consulted: Restaurant 2008 (Keynote) Pizza &Pasta Restaurant 2008 and Restaurant 2008 (Mintel) as the factors supporting future demand

[8] Key Drivers for changes are environmental factors that are likely to have an high impact on the success or failure of strategy. (Johnson et al, 2006 p.56)

[9] The report defines restaurants as eating places that supply meals or food for consumption on the premises by UK consumers, except roadside catering and contract catering.

[10] At the end of 2006 financial year

[11] The same report forecasts a growth of 22.5% between 2009 and 2013; however with the UK economy heading towards a Recession this projection is likely to be revised downward.

[12] “The result is that there will be several high-profile casualties as the growth that was servicing debts evaporates and companies are unable to meet their obligations”. (Mintel: Restaurant, 2008)

[13] Necessities (time-poor workers), willingness to try new food and an higher sophistication of the consumer’s taste are mentioned by all three report consulted: Restaurant 2008 (Keynote) Pizza &Pasta Restaurant 2008 and Restaurant 2008 (Mintel) as the factors supporting future demand

[14] Key Drivers for changes are environmental factors that are likely to have an high impact on the success or failure of strategy. (Johnson et al, 2006 p.56)

[15] The Yum! China Division (includes mainland China, Thailand and KFC Taiwan).

[17] Managing director of the China Market Research Group

[18]Burger King joins McDonald’s and Yum! In China announcing plans to open between 250 and 300 outlets over the next five years ( The Economist, 2008)

[20] “An once-in-a-lifetime crisis, and possibly the largest financial crisis of its kind in human history”.( Charlie Bean, deputy governor of the Bank of England cited in The Times Online, 2008)

[21] In September 2008 the group reported a 39 per cent fall in first-half pre-tax profits, while Tragus, said like-for-like sales increased 3.4 per cent in the 12 months to May 25, compared with a 9.7 per cent increase seen the year before. (FT, 2008)

[22] "We are better suited than most to perform even in times of economic turmoil” (Novak D. cited in Forbes,2008)

[23] Today's figures from Diabetes UK show five million people are registered as obese by their GPs, up from 4.8 million in 2006-07 ,( The Independent, 2008)

[24] Indeed, a quick-service restaurant often offers simple menus with ordinary foods that can easily obtained on the wholesale market and consequently be low-priced. On the other hand, fine-dining restaurants tend to offer rare dishes that require a more expensive preparation.

[25] Yum Brand has spent in UK in 2008 a combined £35,626,000 with the Pizza Hut and KFC brands

[26] And KFC obviously only to chicken

Bibliography

Books

Doyle, P. & Stern, P. (2006). Marketing Management and Strategy (Fourth Ed.). London: Pearson Education Limited.

Johnson, G., Scholes, K. & Whittington, R. (2008). Exploring Corporate Strategy (Eight Ed.). London: Pearson Education Limited.

Kotler, P., Armstrong, G., Saunders, J., & Wong, V. (2005). Principles of Marketing (Fourth European ed.). London: Pearson Education Limited.

Online Articles

Yum! to you … David Novak on Yum! Brands 10 years of global growth.( 2007). Bnet [Internet], 15 October 2007. Available from: [Accessed November 10, 2008].

Yuk P.W. (2008) Tragus hurt as diners lose their appetite. Financial Times [Internet], 15 September 2008. Available from :< http://www.ft.com/cms/s/0/88e7f068-8356-11dd-907e-000077b07658.html?nclick_check=1> [Accessed November 11, 2008].

Trout, J.(2006). Peter Drucker on Marketing. Forbes [Internet],07 March 2006. Available from: [Accessed November 6, 2008].

Yum brands predicts profit growth for 2009. (2008). Forbes [Internet], 06 August 2008. Available from: [Accessed November 03, 2008].

O'Flaherty, K., (2008). Marketing Trends: In the name of progress - Marketing Week. [Internet], 16 October 2008. Available from: [Accessed November 13, 2008].

McDonald's profit up, but worries weigh.(2008). Reuters [Internet], 22 October 2008. Available from: [Accessed November 11, 2008].

Clark, N. (2008). Marketing can prove its worth in the boardroom. The Economic Times [Internet],15 October 2008. Available from: [Accessed 05 November 2007].

Guardian. [Internet], 21 October 2008. Available from:

Laurance, J., (2008). Diabetes may cause first fall in life expectancy for 200 years . The Independent. [Internet], 20 October 2008. Available from :< http://www.independent.co.uk/life-style/health-and-wellbeing/health-news/diabetes-may-cause-first-fall-in-life-expectancy-for-200-years-966914.html> [Accessed November 15, 2008].

Name change for Pizza Hut (2008) The Independent. [Internet], 06 October 2008. Available from: [Accessed November 15, 2008].

Websites

Deloitte Global Home Page - Deloitte Touche Tohmatsu [Internet]. Available from: [Accessed November 14, 2008].

Restaurant (2008) Keynote [Internet], October 2008. Available from: < http://0-www.keynote.co.uk.lispac.lsbu.ac.uk/kn2k1/CnIsapi.dll?nuni=34041&usr=11844srv=03&alias=kn2k1&uni=1226711466&fld=J&Jump=ViewPDF>[Accessed 05 November 2008].

Pizza and Pasta Restaurants - UK January 2008- Market Research Report (2008). Mintel [Internet], January 2008. Available from: [Accessed 06 November 2008].

Restaurants - UK - April 2008 - Market Research Report. (2008). Mintel [Internet], April 2008. Available from:

Yum! Brands, Inc. (2008).[Internet]. Available from: [Accessed November 10, 2008].

Online Journal Articles

Allen, R.S. & Helms, M.M. (2006). Linking strategic practices and organizational performance to Porter's generic strategies. Business Process Management Journal, 12(4), 433-454. Available from: [Accessed November 10, 2008].